There are numerous factors to consider when choosing an automated forex trading strategy. Here are some suggestions for choosing the best automated strategy that meets your requirements. This will help determine which strategies best align with your objectives.

The Trading Style - Different styles of trading can be utilized to trade automated strategies, including trend following, mean-reversion and scalping. Select an automated strategy that fits your preferred method of trading and take into consideration.

Backtesting Results- Prior to making a decision on an automated trading strategy to use, it is vital to test the effectiveness of the strategy using historical market data. This will enable you to determine whether the strategy will be profitable under live trading conditions.

Risk Management- You should look at the risk management strategies that are included in the automated trade strategy. These tools can help you to minimize the risk of losing significant sums and will help you manage the risk of trading.

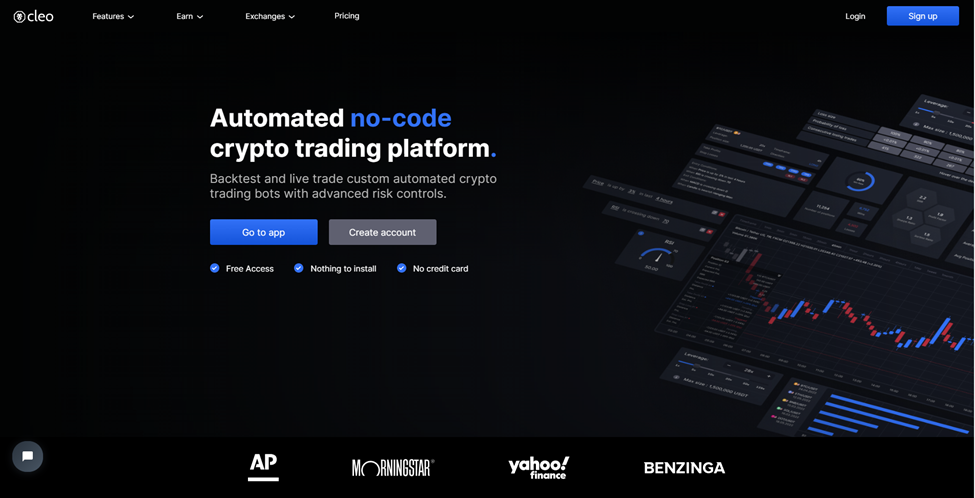

Easy of Use- Take into consideration the ease of use and accessibility to the strategy for automated trading. It is important to choose one that is easy to set up and manage, especially if you are new to the automated trading.

Customer Support- Make sure you are aware of the quality of customer service provided by the company. This will enable you to quickly address any issues or questions that might arise while using the strategy.

In the end, deciding on the best automated trading method for forex trading requires careful consideration of a variety of factors, including your trading objectives, the way you trade, the backtesting process as well as risk management, accessibility, and customer support. You should thoroughly investigate and analyze each option before you decide. If necessary, seek professional advice. See the most popular what is backtesting for website info including automated trading bot, stop loss order, algorithmic trading strategies, backtesting trading, backtesting in forex, crypto daily trading strategy, forex tester, crypto trading, divergence trading, best crypto trading bot and more.

How Does Automated Trading Strategies Work?

Description- This describes the underlying strategy or method used to generate automated trading strategies. This can include a variety of different components including the use of fundamental analysis, technical analysis, or a combination of both. The description should provide an easy and succinct overview of how the strategy works, what it aims to accomplish, and how it creates trading signals.Entry-Exit Signals- Entry and exit signals are specific criteria used to initiate and close trades. These signals can come from a variety sources, including technical analysis, fundamental analysis, or machine learning algorithms. The quality of the entry- and exit signals may affect the overall performance.

Application- What is an automated trading system? is utilized in real-time trading. That means that trades could be performed automatically by through generated signals. The application that is used for strategy should be easy to use and effective, so that traders are able to implement it and control it.

Leverage - The term used to describe the process of borrowing capital in order to increase the possibility of profit on an investment. Automated trading strategies may utilize leverage to increase sizes of trades and yield higher profits. However, leverage can also amplify the potential losses, so it is important to use it with care and be aware of the risks that are involved.

In conclusion, these aspects such as Description, Entry-exit signals application and leverage are all important factors to consider when evaluating and choosing automated trading strategies. Knowing these aspects will allow you to comprehend the strategy more effectively and allow you to make more informed decisions on whether it's suitable for your particular needs and objectives. Follow the recommended automated trading bot for website tips including best crypto indicators, software for automated trading, trading platform cryptocurrency, backtesting, backtesting, best crypto trading bot, algorithmic trading software, position sizing trading, crypto backtesting platform, are crypto trading bots profitable and more.

Forex Automated Forex Trading Is More Suited For Advanced Traders

Many factors make automated forex trading more attractive to experienced traders. The advanced traders who possess a thorough understanding of the market for forex and trading concepts are better equipped to benefit from automated trading.

Trading Experience - Automated trading strategies use algorithms and mathematical models to make trades. These strategies can be used by advanced traders who have a greater understanding of the market's trends and behaviour to make educated decisions and analyze their performance.

Risk Management - Automated strategies for trading are designed to include sophisticated risk management strategies such as stop-loss and size of the position. These concepts can help experienced traders successfully implement these strategies, and lower the possibility of losing a significant amount.

CustomizationStrategies for automated trading can be tailored to meet the needs and objectives of the trader. Expert traders, with an in-depth knowledge of their style of trading and risk tolerance, can create and modify automated trading strategies that meet their needs.

A forex trader who has more experience in trading and has greater technical expertise than a novice can benefit from automated forex trading. Automated trading does not guarantee success. Therefore, all traders should evaluate and test any automated trading strategy prior applying it to live trading. Check out the best cryptocurrency trading for more examples including automated trading platform, backtesting in forex, backtesting platform, trading platform, algorithmic trading bot, cryptocurrency trading, crypto backtest, rsi divergence, best crypto trading bot, crypto strategies and more.

How To Apply A Forex Hedging Strategy

A forex hedging strategy is a risk management technique used to protect the current foreign exchange investment or trade from an adverse price movement. This step-by-step guide will guide you to how to use strategies for forex hedging. Determine the risk: The first step to forex hedging is to determine what risks you would like to hedge against. This could be a risk related to a specific currency pair, a market segment, or even a geopolitical issue.

Select a hedging instrument - There are many instruments you can use to hedge, such as forward and options. You must select the hedging instrument that is the best suited to your needs and goals.

Find the most effective hedge ratio. This is the measure of how large the hedge position is in relation to the original trade, investment, or trade. The right hedge ratio will be determined based on your risk tolerance and market conditions as along with the risks you want to protect yourself against.

The hedging strategy is able to be implemented. After you've selected the hedge ratio, it is possible to create a account for hedging and then execute your forex hedging plan. This is usually a transaction which you make in the reverse direction as your current position with an amount equal to or more than the hedge ratio.

Check the performance of the hedge You'll need to monitor the effectiveness of your hedge strategy and adjust it if necessary.

Strategies for hedging forex are beneficial tools to manage the risk of trading in forex. It is essential to understand the particular risks you are trying to protect against as well as how to choose the appropriate hedging instrument and also how to measure the results of your hedge position. A financial advisor must be consulted prior to the implementation of any hedging strategy.